How Streaming is Driving a Seismic Shift in Super Bowl Advertising

It’s baked into every programmer’s calendar. Seared into the minds of marketers as a period where consumer oxygen is at a premium. And it’s perhaps the one time of year when consumers are — wait for it — looking forward to TV commercials.

The Super Bowl is unquestionably the media and advertising event of the year.

And rightfully so.

At a time when audience attention is splintering and watching TV is becoming an exercise in hopping between streaming services, the Super Bowl stands out as a moment when audiences agree to watch the same ball, at the same time, and enjoy a shared experience.

Fox Sports is reporting 182.5 million people watched some portion of the 2023 Super Bowl this year (when you factor in streaming, linear, and all the parties, bars and out of home viewing).

It almost feels like linear was baked irreversibly into the zeitgeist — but in reality, we’re on the back side of peak appointment TV. Sports and news have helped traditional TV hang in there, and free ad-support streaming TV (FAST) channels may resurrect old feelings of linear television.

But as streaming TV takes over our screens, one big question remains:

What will happen to the Super Bowl and events like it?

NFL follows viewers to streaming services

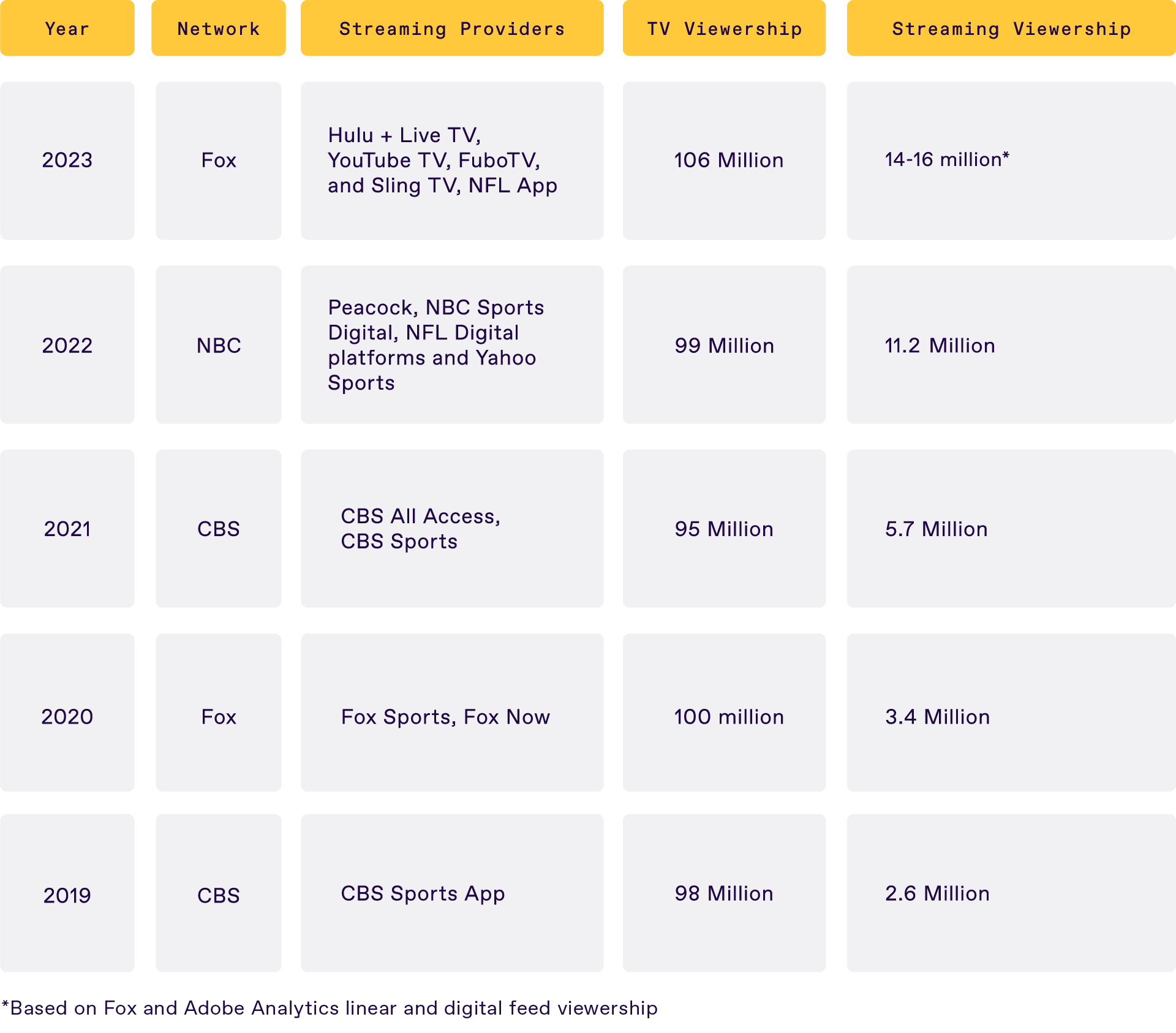

While Super Bowl viewership on traditional TV has skewed flat or downward over the past ten years, streaming has been on a significant upswing. It almost doubled between 2021 and 2022, and every indicator shows that will continue.

Growing numbers of Super Bowl streamers reflect consumer viewing trends at large, and the NFL is following the eyeballs.

Last year, the NFL announced an 11-year deal with NBC, Fox, and CBS that — for the first time — explicitly granted the networks rights to stream football. Google, Apple, and Amazon are all of the NFL pie, looking for new ways to take the NFL’s content to a younger generation of fans.

Amazon entered the fold, securing the rights to Thursday Night Football. Despite missing ratings targets, Amazon is bullish about the value that NFL programming will bring to its media business. YouTube also earned the , and streaming giant even advertised the deal during the big game with a YouTube-famous mascot:

The YouTube deal represents a shift in thinking from the NFL, which intentionally sought a streaming service to diversify the program’s audience base — and follow the cord-cutting eyeballs.

Advertising opportunities extend beyond the main event

As long as there are big audiences, there will be advertisers ready to pay to reach them. After all, that is one of the things TV is best at. For the hefty price of a Super Bowl ad ($7M for 30 seconds this year), brands can pick up some semi-exclusive prestige and implied trust by association that you just can’t get on late night TV.

That said, the most successful advertisers realize that big tent pole moments are only one touch. To get consumers to move any direction in a funnel, there needs to be a frequency and a relevance to the audience.

This is where streaming comes in.

Apple recognized the need for additional, relevant touchpoints, when the brand not only sponsored the Super Bowl halftime show, Rihanna’s Road to Halftime — but also negotiated:

A music video with fans of all 32 NFL teams singing Rihanna’s “Stay”

A 10-part streaming-radio series about the greatest Super Bowl halftime shows ever

The rights to curate an “official collection of 32 playlists featuring the top songs that each NFL team listens to in the locker room, the weight room, and on game day.”

All of this streaming content, derived from the Super Bowl and the halftime show, provide the publisher and its advertisers with new and valuable opportunities to connect with audiences — that don’t cost $7M.

And it doesn’t stop there. With its NFL Sunday Ticket programming, YouTube will stream the ads that come through the national TV broadcaster — but the streaming service will sell and fill ad slots that would go to the local network affiliates.

“The local ad inventory is something that YouTube will monetize,” explained, NFL’s head of media strategy and business development.

These various streaming advertising opportunities are arguably more valuable than a coveted Super Bowl spot because they not only offer the premium content and high emotional impact of television, but also hyper-targeted, local audiences — all at a much more palatable cost.

Streaming audiences in ad-supported formats are willing to exchange the value of a premium content experience for 6-, 15-, or 30-second advertising message — especially if the ad is able to strike a chord with the audience. While personalization and relevance is hard to achieve on linear TV, all streaming advertising is informed.

Brands just need to find partners to make sure frequency is right, audience is right and content next to is in fact premium.

High value content will always attract advertisers

It’s true that not all video content is created equal.

As audiences cut the cord and shift to streaming, we’ve seen numerous examples in which TV inventory has been commoditized and lost its pricing power.

High value content will always attract ad dollars, but advertisers need the right technology and expertise to access it. The Super Bowl is a prime example. It highlights the undeniable impact and emotional value of the television experience.

However, it no longer takes a Super Bowl ad to reach TV audiences in a meaningful way. Viewers will continue to watch the game across a variety of channels and devices for years to come — and advertisers will continue to buy ads.

The question is: How will brands and advertisers use the power of streaming TV to reach the next generation of Super Bowl fans?